Us mortgage how much can i borrow

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

How Much Can I Borrow The Key To Affordability The Borrowers Mortgage Debt Estate Tax

You can also connect with a home mortgage consultant and have a conversation about your home financing needs your loan choices and how much you may be able to borrow.

. Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily. However mortgage lenders will also consider any financial commitments you may have. Check Eligibility for No Down Payment.

Four components make up the mortgage payment which are. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. Ad Compare the Best Cash Out Refinancing Mortgage Rates in Just 2 Min.

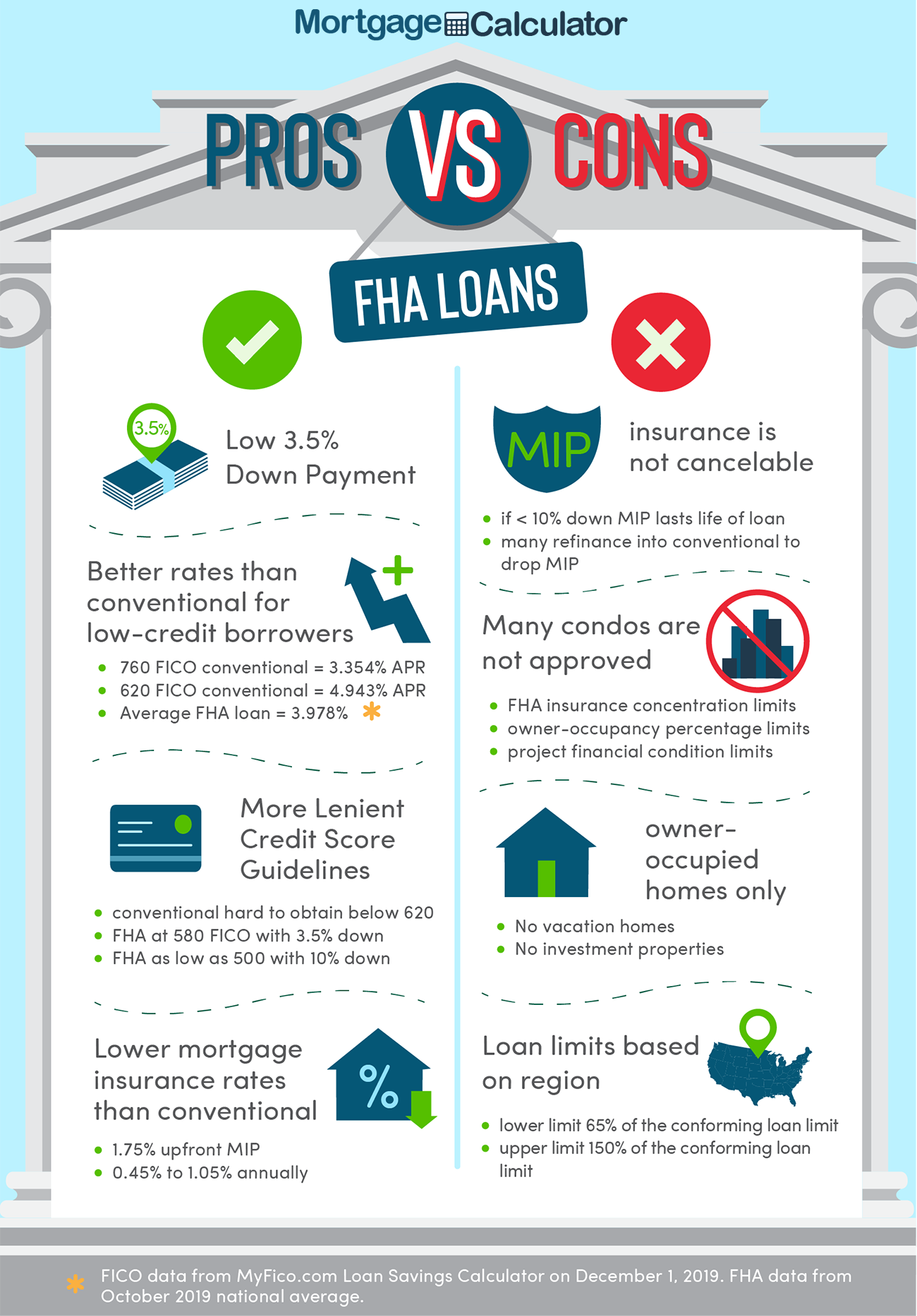

Lock Your Rate Now With Quicken Loans. Ad Were Americas 1 Online Lender. 455 31 votes So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan.

The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Ad Get Your Best Interest Rate for Your Mortgage Loan. Arizona Mortgage Banker License 0911088.

Of numerous borrowing from the bank connection financing will definitely cost step one a month on the cutting balance from financing an apr of twelve7. Unlike other types of FHA loans the maximum. Theyll also look at your assets and.

Fill in the entry fields. Lock Your Rate Now With Quicken Loans. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Use your salary and your partners to find out how much you could borrow. Saving a bigger deposit. Please get in touch over the phone or visit us in.

Calculate how much you could borrow with our mortgage borrowing calculator. The first step in buying a house is determining your budget. If you earn 50000 as long as you dont have loans and credit cards that need to be accounted.

Which mortgage lenders will lend 5 times salary. Compare - Apply Get Cheap Rates. 2 x 30k salary 60000.

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. For you this is x.

The results are estimates that are based on. How much can I borrow. Most lenders cap the amount you can borrow at just under five times your yearly wage.

The Search For The Best Mortgage Lender Ends Today. Trusted VA Home Loan Lender of 200000 Military Homebuyers. Ultimately your maximum mortgage.

The optimal amount for the best possible mortgage deal is 40 per cent. Ad Were Americas 1 Online Lender. For example lets say the borrowers salary is 30k.

Total Monthly Mortgage Payment. If you want a more accurate quote use our affordability calculator. This calculator is being provided for educational purposes only.

Ad More Veterans Than Ever are Buying with 0 Down. The sweet spot for getting a better mortgage deal is a 25 per cent deposit. The amount you could borrow will largely depend on your income.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Find Mortgage Lenders Suitable for Your Budget.

Compare Quotes See What You Could Save. Calculate what you can afford and more. Ad Calculate How Much Mortgage Can You Afford Backed By Top Mortgage Lenders Save.

Now you should be basing your initial calculations on 4-45 times your income. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Figure out how much mortgage you can afford.

Take Advantage And Lock In A Great Rate. So if your lender is. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Across these lenders there are. Special Pricing Just a Click Away - Get Started Now See For Yourself.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Lender Mortgage Rates Have Been At Historic Lows. A general rule is that these items should not exceed 28 of the borrowers gross.

That means for a first-time home buyer. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. You may qualify for a.

Now is the Time to Take Action and Lock your Rate. Interest principal insurance and taxes. Depending on a few personal circumstances you could get a mortgage.

This mortgage calculator will show how much you can afford. Compare Quotes Now from Top Lenders. Now is the Time to Take Action and Lock your Rate.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. You can borrow up to 381000 Monthly Repayment 160631 Fortnightly Repayment 74137 Weekly Repayment 37069 Loan Balance Chart Years Amount Owing Loan Balance Total. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

The Power Of Mortgage Pre Approval Infographic Preapproved Mortgage Mortgage Mortgage Loans

Calculate How Much You Can Borrow With Our Easy To Use Mortgage Affordability Calculator Plus Estimate Mortgage Payment Calculator Mortgage Payment Mortgage

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Home Buying

5 Tips To Taking Home Loan In Texas Mortgage Loans Home Loans Va Mortgage Loans

Learn Everything You Need To Know About Mortgages

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Get Car Title Loans In Red Deer Car Title Deer Car Red Deer

Pin On Mortgage And Loan

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Wondering How Much Home You Qualify For Interest Rates Have A Big Impact On Your Ability To Borrow Lea Fixed Rate Mortgage The Borrowers Real Estate Services

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

What Is Loan Origination Types Of Loans Personal Loans Automated System

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Pin On Mortgage Choice Jody Shadgett West Torrens